How much do you get for your vehicle if it is totaled?

If your car has been totaled, your insurance company is going to try to pay as little as possible for the vehicle. If you think the value of your car is worth more than your auto insurance is offering, you might need these tips for negotiating with insurance on a totaled car.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Jun 22, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jun 22, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Were you recently involved in an accident that totaled your car? If so, you may be having a hard time negotiating with insurance on a totaled car.

One of the most common misunderstandings that most people have when dealing with an insurance company is the belief that they will be paid the price they paid for their car if it is totaled.

Unfortunately, that is not the case – and in most situations, you might not even get true full market value for your car.

This is more common than you think. More than 5 million vehicles are totaled each year.

So, what can you do about it? Knowing the best process for negotiating a total loss settlement is a good first step.

Make sure you have comprehensive and collision coverage before you start to negotiate with any insurance carrier about your totaled vehicle.

How much can I get by negotiating with insurance on a totaled car?

Your insurer is not going to give you more money for your car simply because you think it is worth more than their estimate, just as they will not allow you to determine your own insurance rates or insurance claims.

The bad news is, if you want more money for your car, you’re going to have to spend time negotiating with insurance on a totaled car, regardless of if you consider your insurer to participate in fair dealings during the total loss settlement negotiation process.

The good news is, as you continue reading, you’ll better understand how your company determines the value of your car.

You’ll also learn about a few strategies that you can use to maximize the actual cost that your insurer will give you for your car if it is has been totaled.

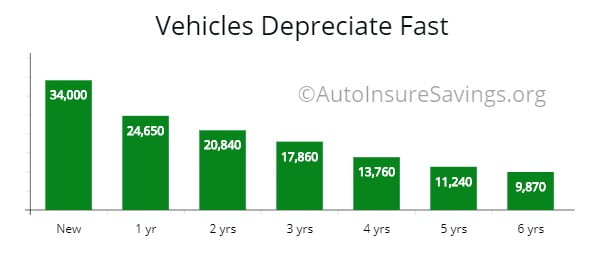

Note: The average vehicle can depreciate from 17% to 30% in the first year according to NADA. Some depreciate up to 38%. When you are attempting to negotiate with an insurer after a total loss claim you are likely to find out your vehicle is not worth as what you expect. Having GAP insurance can insure that you will be able to pay off your loan even if your insurance company says your car is worth less.

Note: The average vehicle can depreciate from 17% to 30% in the first year according to NADA. Some depreciate up to 38%. When you are attempting to negotiate with an insurer after a total loss claim you are likely to find out your vehicle is not worth as what you expect. Having GAP insurance can insure that you will be able to pay off your loan even if your insurance company says your car is worth less.

For now, we will start with an explanation for the fair market value of a car.

This is what insurers are going to use to determine how much your car is worth at the time of the accident. There is information you might want to be aware of too if you plan on negotiating a totaled car settlement.

Some insurers are NOT going to use the plain meaning of “pre-accident” value, but the “investment” of the repaired vehicle. We will go into more detail below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How do insurers determine the fair market value of a vehicle?

The definition of fair market value is when a buyer or seller can agree on a price.

After you’ve been involved in an accident, an insurance adjuster from your carrier will determine the damage to your car.

If the adjuster deems the car to be totaled, a value must then be assigned to the car.

Totaled Loss Claim vs Actual Cash Value

If you have been in an automobile accident and the insurer is determining if your vehicle is a total loss you have to carry comprehensive and collision coverage for a loss payment.

If not, then you would be solely responsible for the loss payment. .

Many insurers are going to look at the cost of the repairs, the salvage value of the vehicle, and the cost to the insurer while the vehicle is being repaired.

If the value of the restored vehicle is more than getting a new one the insurer will file for a total loss.

It wouldn’t be smart financially to repair your car. This is when total loss settlement negotiation becomes necessary.

Below is a table of the total loss value for a vehicle in each state.

For example, in Arkansas if your $10,000 vehicle needs $7,500 in repairs it would be a total loss. In Colorado if your $10,000 vehicle needs $10,000 in repairs it would be a total loss.

What is considered a total loss varies from state to state.

Some use what is called the Total Loss Threshold or TLT where the damage needs to exceed a certain percentage of the vehicle’s value.

The majority of states use what is called Total Loss Formula or TLF where the salvage value and cost of repairs exceed the car’s actual cash value.

| State | TLT / TLF | State | TLT / TLF |

|---|---|---|---|

| Alabama | 75% | Montana | 75% |

| Alaska | TLF | Nebraska | 65% |

| Arizona | TLF | Nevada | 50% |

| Arkansas | 70% | New Hampshire | 75% |

| California | TLF | New Jersey | TLF |

| Colorado | 100% | New Mexico | TLF |

| Connecticut | TLF | New York | 75% |

| Delaware | TLF | North Carolina | 75% |

| Florida | 80% | North Dakota | 75% |

| Georgia | TLF | Ohio | TLF |

| Hawaii | TLF | Oklahoma | 60% |

| Idaho | TLF | Oregon | 80% |

| Illinois | TLF | Pennsylvania | TLF |

| Indiana | 70% | Rhode Island | TLF |

| Iowa | 75% | South Carolina | 75% |

| Kansas | 75% | South Dakota | TLF |

| Kentucky | 75% | Tennessee | 75% |

| Louisiana | TLF | Texas | 100% |

| Maine | 75% | Utah | TLF |

| Maryland | TLF | Vermont | TLF |

| Massachusetts | 75% | Virginia | 75% |

| Michigan | 70% | Washington | TLF |

| Minnesota | TLF | West Virginia | 75% |

| Mississippi | 80% | Wisconsin | 70% |

| Missouri | TLF | Wyoming | 75% |

When assessing the value of your car, the adjuster and the insurer will do the following:

-

Evaluate the condition of the car prior to the accident

-

Research the market value of your car

-

Get 3rd party appraisals of your car

The adjuster will determine if your car is in excellent, good, fair, or poor condition.

Even if you kept your car in pristine shape prior to the accident, the car is not likely to receive an excellent rating after an accident unless it is a few months old or less.

You have to think like an unpressured buyer or seller when attempting to determine the fair market value of vehicle. This is what insurers do.

Once the adjuster has done the job and filed the necessary paperwork, the insurer takes over to figure out the market value of your car.

While one might think that all they need to do is use Kelley Blue Book or Edmunds.com, most companies choose to use their own methods.

For example, if you have State Farm and a totaled car, your State Farm total loss negotiation will be determined by State Farm’s total loss percentage or State Farm’s total loss formula.

The reason is simple – they want to pay out as little as possible.

Although every insurer is different, most will contact local dealerships and 3rd party companies to see what a car similar to yours is selling for in your area.

Whether they look at all the vehicles or a small scale is not known, so it is best that you do your own research.

If you’re still asking the question, “How much will an insurance company give me for my car?” It is at this point that you’ll be able to find your answer.

Your carrier will likely contact you with the dollar number they are willing to pay out for your totaled vehicle.

If you feel that they undervalued your car, then it is important that you speak up sooner rather than later. Ask for a copy of the report they compiled, including all of the information they used to determine your car’s value so you can begin negotiating a totaled car settlement.

Believe it or not, there are many cases in which customers have challenged the value set by top carriers, and as a result, received an extra $1,000 or more for their car.

Best Auto Insurance Companies for Negotiating With Insurance on a Totaled Car

Based on consumer surveys and ratings from reputable sources the top companies to work with when dealing with claims and/or totaled vehicles are USAA, Travelers, Auto-Owners, and Amica.

All of them ranked 98 out of 100, except USAA, which ranked 100 out of 100.

Included in the list rounds out the top 17 companies for claims sanctification across the United States.

If by chance you are going through the brutal process of a totaled car claim with an insurer and want to switch, below are reputable companies with good financial strength.

| Company | Claims Service | AM Best Rating | Score (Out of 100) |

|---|---|---|---|

| USAA | 100 | A++ | 97 |

| Travelers | 98 | A++ | 91 |

| Auto Owners | 98 | A+ | 90 |

| Amica | 98 | A++ | 95 |

| Liberty Mutual | 96 | A | 87 |

| AAA of Southern California | 96 | A+ | 94 |

| Geico | 94 | A++ | 89 |

| CSAA Group (AAA) | 93 | A | 91 |

| Progressive | 93 | A+ | 89 |

| State Farm | 92 | A++ | 91 |

| Allstate | 92 | A+ | 88 |

| Nationwide | 92 | A+ | 89 |

| Hartford | 90 | A+ | 88 |

| American Family | 88 | A | 89 |

| Safeco | 84 | A | 88 |

| Farmers | 83 | A | 82 |

| Erie | 80 | A+ | 86 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Negotiate a Total Loss Settlement

Here’s what you should do.

If you want the extra money that you deserve for your totaled car, don’t just sit around and expect your insurer to pay it out.

Instead, consider using any and all of these tactics:

-

Do your own research.

-

Contact local dealerships.

-

Keep detailed records and take into account any extra options and features your car had.

-

Compare your research with that of the insurer.

-

Be courteous.

-

You are attempting to get the fair market value of the vehicle – not what you think it is worth. What the market or unbiased buyer or seller would agree on a price.

The best thing you can do when negotiating how much you will get from an insurer for your car is to prepare yourself as best as possible.

Research the recent sales of your vehicle online, as well as current sale prices.

How to Determine the Fair Market Value of a Vehicle on Your Own

Not sure where to start?

In addition to using the Internet as a resource to gather sales data, contact local dealerships that sell a make and model that is similar to your vehicle.

They will likely provide with you a higher sales price, which will only work out in your favor.

Lastly, consider using Kelley Blue Book to get the fair market value of your vehicle.

As you conduct your research, make sure to keep detailed records of all the data you gather from all of your sources.

Try to get any sales figures in writing, as you’ll be able to use these to negotiate more money.

Be sure to also locate any information related to the extra options that your car had.

From special car stereos to reverse cameras, those added features could add a bit more money to the check from your insurance company.

Once you’ve compiled all of your data, and received the detailed information from the insurance company, it’s now time to compare your research.

When you conduct your research and come up with a “reasonable” fair market price then try to negotiate a few more dollars out of the insurer.

Look to see where you might be able to squeeze your provider for the extra dollars you deserve.

When you contact your insurance company to state your case and negotiate for the higher value, it is also best to be courteous.

At the same time, however, stand your ground.

The insurance agent at your company will be far more likely to help you out in achieving fair compensation if you come across as confident yet cordial.

Negotiating With Insurance on a Totaled Car: A Final Though

By being informed and following the suggested tactics, you should be able to negotiate more money, no matter what kind of answer your insurance company gives after you ask them what they will give you for your car.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Jun 22, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.