Compare Car Insurance Rates Online – Fast & Easy

The state you reside in or the city within the state can play an important part in your annual car insurance rates.

Many know your age and driving record plays a factor in your final premium.

The best way to compare auto insurance quotes is by entering your Zip Code in the quote box to find the best price

Compare Car Insurance Rates Online

However, your state and zip code is a big factor when car insurance companies decide your bi-annual or annual car insurance quotes.

The average cost of insurance for 2021 is over $1,149 per year.

Your insurance premium depends on factors about you, your vehicle information, and the state or zip code you reside in.

Comparing Car Insurance Rates Online

If you’re shopping for car insurance online, you know many companies are offering you a premium.

All you have to do is enter your information, and the emails, texts, and phone calls come flooding in.

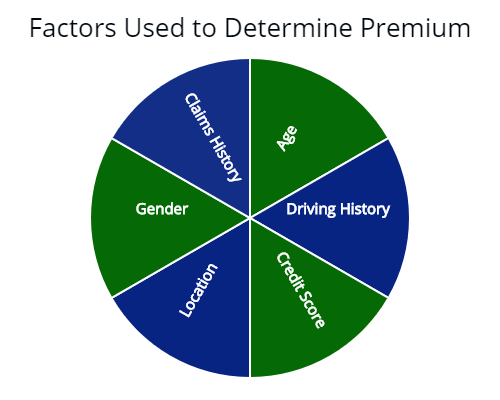

Car insurance companies use rating factors to determine your final policy.

Note: Illustrated above are the biggest factors used by car insurance companies to determine your car insurance quote’s cost. However, insurers are going to put more weight on one factor than the other. Each insurer has a different method of doing so. Therefore, you will get a different quote comparison.

Note: Illustrated above are the biggest factors used by car insurance companies to determine your car insurance quote’s cost. However, insurers are going to put more weight on one factor than the other. Each insurer has a different method of doing so. Therefore, you will get a different quote comparison.

Since “factors” are scored differently by different auto insurers, you will get different priced car insurance quotes during the quoting process.

Ultimately, you could end up paying more by choosing the wrong car insurance company and failing to compare.

In 2021 there are a diverse collection of companies to choose from.

Over 650 companies in the United States.

If you include all types of insurance, there are over 5,900, according to III.org.

This guide is going to help you understand the factors which go into your car insurance quote comparison.

Plus, there shall be a few tips along the way to help find coverage rates when shopping for insurance quotes online.

Comparing Your Car Insurance Rates Online

Your track record determines your car insurance rate as a driver during the quoting process.

As well as your vehicle information, credit, gender, and location.

Insurance companies employ their own method to determine your risk as a driver.

This will be reflected in your insurance premium.

For example, having a poor credit score and driving history can drastically affect what you pay for car insurance coverage.

Below are the demographic, car-related, and driving-habit factors illustrated how insurers determine your auto insurance rate.

| Demographic Factors | ||

|---|---|---|

| Gender and Age | Statistically, young men usually incur higher rates than young women. | |

| Marital Status | Married people tend to have fewer accidents than single people. | |

| Where You Live | A densely populated city with high crime rate will have higher premiums. | |

| Credit Score | Lower score equals higher premiums. | |

| Profession | Work requiring a lot of driving will increase risk and your premium. | |

| Car-Related Factors | ||

| Vehicle Size | Larger cars are generally safer than smaller cars in an accident. | |

| Age of the Car | Older vehicles are more likely to be “totaled” because they aren’t worth the cost of repairs. | |

| Safety Rating | Passengers less like to be injured in an accident means lower rates. | |

| Likelihood of Theft | Car which is likely to be stolen means higher premiums. | |

| Driving Habits | ||

| Driving History | Past driving offenses and accidents equal higher premiums. | |

| Driving Activity | The more you drive the higher chance of an accident equals higher premiums. |

(Table – Source)

Compare Auto Insurance Rates by State

There are state-mandated rate increases on what factors can be used to determine your coverage cost during or after the quoting process.

However, it not just laws driving the state-by-state difference in insurance rates.

In fact, car insurance companies can charge more in places where people are filing more claims.

If you live in a densely populated city with a high crime rate and poor road conditions, an excellent chance drivers are filing claims regularly.

What are you going to pay for an auto insurance policy?

Below is a state-by-state breakdown of an average insurance premium with full coverage limits.

| State* | Annual Premium | State | Annual Premium |

|---|---|---|---|

| Alabama | $1,877 | Montana | $2,206 |

| Alaska | $1,598 | Nebraska | $1,732 |

| Arizona | $2,643 | Nevada | $2,648 |

| Arkansas | $2,052 | New Hampshire | $1,922 |

| California | $1,953 | New Jersey | $2,318 |

| Colorado | $2,498 | New Mexico | $2,100 |

| Connecticut | $2,512 | New York | $2,532 |

| Delaware | $2,059 | North Carolina | $2,498 |

| Florida | $2,712 | North Dakota | $1,655 |

| Georgia | $2,500 | Ohio | $1,640 |

| Hawaii | $1,455 | Oklahoma | $2,262 |

| Idaho | $1,501 | Oregon | $2,200 |

| Illinois | $2,185 | Pennsylvania | $2,100 |

| Indiana | $1,488 | Rhode Island | $2,821 |

| Iowa | $1,472 | South Carolina | $2,015 |

| Kansas | $2,022 | South Dakota | $2,282 |

| Kentucky | $2,665 | Tennessee | $1,861 |

| Louisiana | $2,721 | Texas | $2,423 |

| Maine | $1,268 | Utah | $2,411 |

| Maryland | $1,983 | Vermont | $1,700 |

| Massachusetts | $1,860 | Virginia | $1,409 |

| Michigan | $3,982 | Washington | $1,622 |

| Minnesota | $2,134 | West Virginia | $2,095 |

| Mississippi | $1,994 | Wisconsin | $1,550 |

| Missouri | $2,417 | Wyoming | $1,832 |

*With Bodily Injury Liability, Property Damage Liability, Personal Injury Protection (if the state requires it), Uninsured Motorists Coverage, Underinsured Motorists Coverage, and Medical Payments Coverage. (if the state requires it). Average auto insurance rates for a driver with a clean driving history. Optional insurance coverage, such as roadside assistance, is not included.

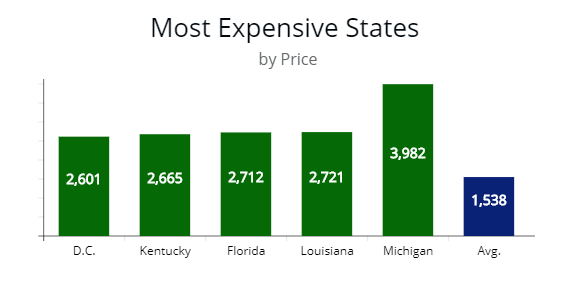

Comparing the State with Highest Car Insurance Rates

Below is a list of states with the highest average premium.

Note: Illustrated above are the most expensive states to buy an auto policy. They are Michigan, Louisiana, Florida, Kentucky, and the District of Columbia. (Source) Your quotes may vary by zip code.

Note: Illustrated above are the most expensive states to buy an auto policy. They are Michigan, Louisiana, Florida, Kentucky, and the District of Columbia. (Source) Your quotes may vary by zip code.

This changes from time to time.

Michigan has been the most expensive state for years now.

The primary driver in Michigan is a no-fault state, which allows drivers to recoup financial losses from their car insurance company no matter who is at fault.

| State | Total | Liability | Collision | Comprehensive |

|---|---|---|---|---|

| Michigan | $3,982 | $1,911 | $1,185 | $886 |

| Louisiana | $2,721 | $1,333 | $843 | $545 |

| Florida | $2,712 | $1,247 | $867 | $598 |

| Kentucky | $2,665 | $1,305 | $874 | $486 |

| District of Columbia (D.C.) | $2,601 | $1,248 | $891 | $462 |

As you can see, many different variables are influenced when using a car insurance comparison tool.

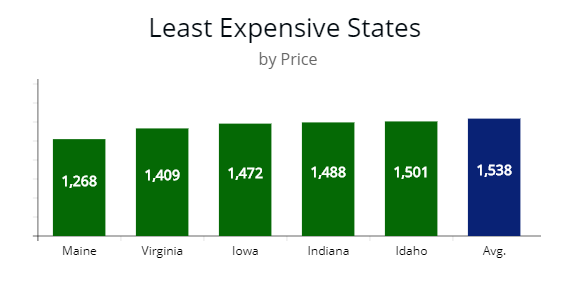

Comparing the States with the Lowest Car Insurance Rates

Generally speaking, the states with the lowest insurance rates are less densely populated and have lower insurance claims.

Note: Illustrated above is the least expensive state to get an auto insurance policy. The cheapest is Maine at $1,268 per year. Followed by Virginia, Iowa, Indiana, and Idaho. All clustering around $1,400 per year for full coverage. Your quote may vary by zip code.

Note: Illustrated above is the least expensive state to get an auto insurance policy. The cheapest is Maine at $1,268 per year. Followed by Virginia, Iowa, Indiana, and Idaho. All clustering around $1,400 per year for full coverage. Your quote may vary by zip code.

States such as Virginia mandate a $500 fee to forgo insurance coverage.

Idaho doesn’t mandate personal injury protection (PIP) and uninsured motorists protection.

Maine’s population base is much older, and the majority of drivers are 40 and up.

| Cheapest States | Total Premium | Liability | Collision | Comprehensive |

|---|---|---|---|---|

| Maine | $1,268 | $608 | $474 | $189 |

| Virginia | $1,409 | $648 | $543 | $218 |

| Iowa | $1,472 | $691 | $561 | $220 |

| Indiana | $1,488 | $759 | $495 | $234 |

| Idaho | $1,501 | $956 | $660 | $260 |

You might not live in one of the cheapest states to insure your vehicle.

If you don’t, there are a few things you can do to lower your insurance premium.

The most important is to keep a clean driving history.

Also, keep a good credit score, and don’t let your car insurance lapse.

Comparing Car Insurance Quotes Online by Average Cost

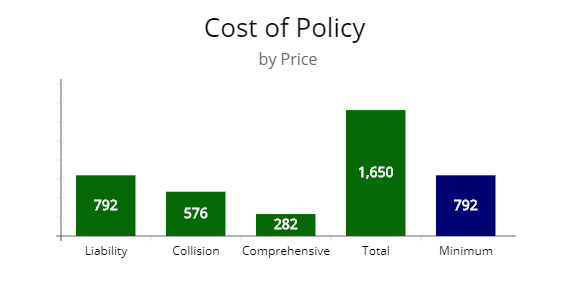

There are specific types of protection that make up your current policy from auto insurance companies.

This will determine your monthly premium price and the insurance coverage limits when going through the quoting process.

The main types of auto insurance are:

- Liability insurance

- Comprehensive insurance

- Collision insurance

You are certainly going to have liability coverage.

This is required in most states.

Liability coverage will protect you from costs incurred if you injure someone or damage another person’s property with your vehicle.

Comprehensive and collision is coverage that protects your vehicle. They are optional unless you have financed your vehicle.

When you have liability (bodily injury liability & property damage liability) comprehensive and collision, this is commonly referred to as “full coverage.”

Note: Illustrated above is the cost for liability, collision, and comprehensive to get a full coverage price of $1,650 per year. Many drivers get minimum liability coverage or liability only, which is illustrated in blue at $792. This is a way to save money on auto insurance, but it does come with risk. Make sure to consult with an insurer before dropping coverages.

Note: Illustrated above is the cost for liability, collision, and comprehensive to get a full coverage price of $1,650 per year. Many drivers get minimum liability coverage or liability only, which is illustrated in blue at $792. This is a way to save money on auto insurance, but it does come with risk. Make sure to consult with an insurer before dropping coverages.

Comprehensive and collision coverage will protect you if your vehicle is damaged from an automobile accident or damaged from a fallen tree branch, as an example.

Many drivers opt to forgo comprehensive, and collision protection since you can lower your monthly auto insurance rates significantly by doing so.

However, skipping out on comprehensive and collision can lead to bigger expenses down the road if you are stuck with vehicle repairs.

Below I have a breakdown of each car insurance rate for a driver profile with a $1,650 full coverage policy.

| Type Coverage | Cost | Minimum Coverage |

|---|---|---|

| Liability | $792 | $792 |

| Collision | $576 | 0 |

| Comprehensive | $282 | 0 |

| Total | $1,650 | $792 |

If you forgo comprehensive and collision, the price of the policy is only $792.

Significant savings, but it does come with risk.

For example, if someone “keys” your car, you would be on the hook for repairs.

Compare Auto Insurance Rates by Minimum Coverage

Minimum coverage means to carry only liability.

There may be other “add-ons” required in some states.

For ease, I will refer to minimum coverage as liability only or vice versa.

There are times when full coverage insurance is not worth it.

If you have a vehicle worth $4,000 or less and can do your own repair work, carrying full coverage is probably not cost-effective.

For example, your vehicle is only worth $4,000, or you fix the repairs yourself.

You probably should drop comprehensive and collision.

If you can’t afford a current auto insurance policy with comprehensive and collision at the moment, you may have to carry minimum liability coverage.

It is better to have protection than none at all or let your current policy lapse.

It would spike your car insurance quotes the next time you get a policy.

Compare Car Insurance Quotes by Age

Age is a factor that affects your auto insurance price during the quoting process.

Generally, the older you are, the lower your premium until about 65 or so.

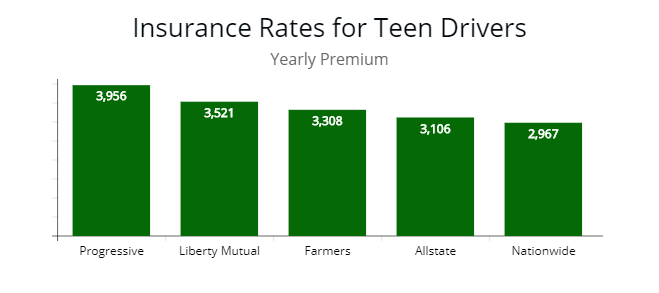

If you are a teen driver, you could pay into the thousands.

Parents of teen drivers have seen their car insurance rate quote more than double.

Note: Illustrated above is the cost of a premium for a 17-year-old driver profile. The prices are typically double or more of the average price. Insurers will classify teen drivers as one of the riskiest drivers on the road. Therefore, they will have the highest premiums.

Note: Illustrated above is the cost of a premium for a 17-year-old driver profile. The prices are typically double or more of the average price. Insurers will classify teen drivers as one of the riskiest drivers on the road. Therefore, they will have the highest premiums.

Below are illustrations comparing the price of different insurers by quote comparison for teen drivers.

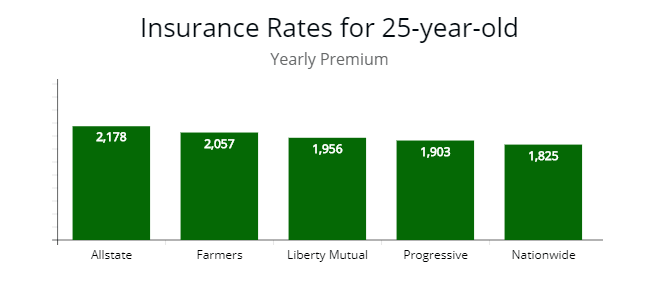

Car insurance rates for drivers 25 years of age and older, the price of an insurance policy is much better than being a teen (young) driver since this is usually the age where auto insurance rates decrease.

Note: The cost of a car insurance quote drops significantly for a 25-year-old driver. This is the age or “sweet spot,” where rates for drivers get a drop in a premium assuming they have a clean driving history. Though coverage rates drop, it is good to compare other companies’ auto insurance quotes since the price variance is over 20% from one insurer to the next.

Note: The cost of a car insurance quote drops significantly for a 25-year-old driver. This is the age or “sweet spot,” where rates for drivers get a drop in a premium assuming they have a clean driving history. Though coverage rates drop, it is good to compare other companies’ auto insurance quotes since the price variance is over 20% from one insurer to the next.

The age of 25 is the turning point for most drivers since the price drops significantly, as you can see in the illustrations.

Average Monthly Auto Insurance Rates for a 25-Year-Old

| Company | 25-year-old with minimum coverage | 25-year-old with full coverage |

|---|---|---|

| American Family | $57.58 | $152.75 |

| Geico | $48.25 | $132.58 |

| Farmers | $58.42 | $171.42 |

| State Farm | $50.92 | $135.25 |

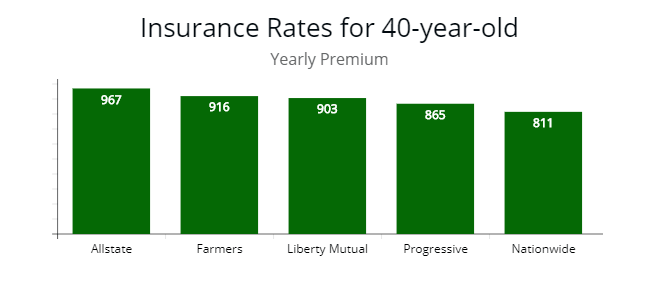

After you hit the age of 40, your premiums are nearing the cheapest they will be with a clean driving history.

This is the age where premiums don’t fluctuate much based only on age or gender.

Note: At the age of 40, drivers see the cheapest car insurance quote assuming they have a clean driving history. Make sure to compare rates to get the best coverage at 40 or older.

Note: At the age of 40, drivers see the cheapest car insurance quote assuming they have a clean driving history. Make sure to compare rates to get the best coverage at 40 or older.

Assuming all metrics are constant, this is where many men begin to see a slight decline in coverage rates against women.

While men will pay significantly more at a young age.

Average Monthly Auto Insurance Rates for a 40-Year-Old

| Company | 40-year-old with minimum coverage | 40-year-old with full coverage |

|---|---|---|

| American Family | $45.75 | $102.75 |

| Geico | $39.83 | $99.83 |

| Farmers | $76.33 | $155.42 |

| State Farm | $42.83 | $135.25 |

Compare Auto Insurance Rates by Driving History

It will be difficult to find an affordable auto insurance policy if you have a poor driving history.

Auto insurance companies are going to use your past driving history as an indicator of your future risk.

One ticket or traffic violation can increase auto insurance rates by 15%.

Note: Illustrated above is the cost of an insurance premium before and after an at-fault accident. As you can see, your premiums can nearly double after an at-fault violation. All things being equal, most insurers had a 40% spike in auto insurance rates. Make sure to compare rates to find the best coverage after an accident.

It will be nearly impossible for you to find another car insurance company that won’t hike your coverage rates after a ticket or traffic violation.

Average Monthly Auto Insurance Rates with Clean Driving History vs a Recent At-Fault Accident

| Company | Drivers with a clean driving history | Drivers with a recent at-fault accident |

|---|---|---|

| American Family | $102.75 | $115.92 |

| Geico | $99.83 | $157.33 |

| Farmers | $155.42 | $231.92 |

| State Farm | $125.92 | $164.00 |

| USAA* | $85.25 | $123.50 |

*USAA is for military members, spouses, and direct family members.

One thing to consider, the amount of car insurance rates that increase varies from company to company.

The more serious the speeding ticket or traffic violation, the higher the rate hike.

Illustrated are auto insurance quotes before and after a violation.

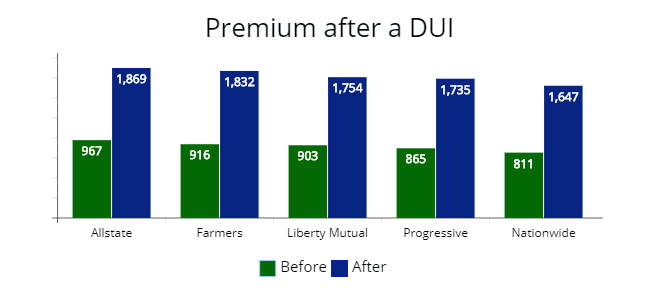

Getting a DUI can raise your auto premium significantly.

Average Monthly Auto Insurance Rates with and Without a DUI

| Company | Drivers without a DUI | Drivers with a DUI |

|---|---|---|

| American Family | $102.75 | $116.42 |

| Geico | $99.83 | $228.58 |

| Farmers | $155.42 | $238.83 |

| State Farm | $125.92 | $212.42 |

In the majority of cases, the average driver with a DUI will see their auto insurance double for a period of three years or more.

In California, a DUI can stay on your record for 10 years.

If you are in this unfortunate situation, make a car insurance comparison to find a more affordable premium.

Below is a comparison of coverage rates before and after a DUI from various zip codes.

Note: Getting a DUI will double your quote when comparison shopping from insurers. Some insurers will drop you from a policy. If you are in this scenario, finding insurers who specialize in high-risk premiums are the best. Progressive is one such car insurance company. Make sure to compare rates after a DUI to save money.

Note: Getting a DUI will double your quote when comparison shopping from insurers. Some insurers will drop you from a policy. If you are in this scenario, finding insurers who specialize in high-risk premiums are the best. Progressive is one such car insurance company. Make sure to compare rates after a DUI to save money.

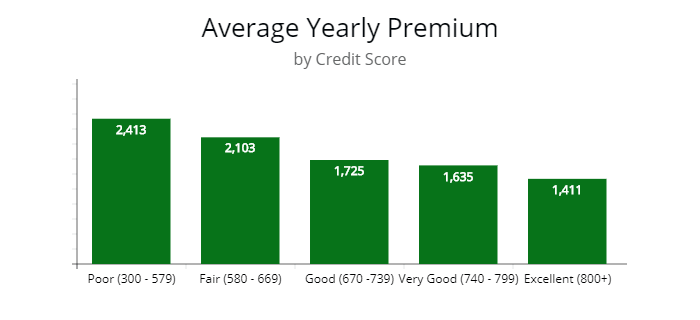

Compare Car Insurance Quotes by Credit Scores

Another big contributor to auto insurance costs is your credit score.

While many drivers don’t like it, auto insurance companies use it to determine your level of risk as a client.

If you see an increase in a car insurance quote unexpectedly, you may want to find out if your credit score went down.

There are situations where a person financed home improvement work on their house.

In turn, their credit score went down, and their average rates went up.

Depending on how low your credit history is, it depends on how much you will pay for a policy with most auto insurance types.

Note: Illustrated above are the rates for drivers with poor to excellent credit. Your credit tier is a major factor when determining your auto insurance premium. If you have excellent credit and your score suddenly dips lower, you could get hit with a rate hike. The difference in price from excellent to bad credit is over $1,000. Make sure to keep a good credit score, so you can compare rates to find the best coverage.

Note: Illustrated above are the rates for drivers with poor to excellent credit. Your credit tier is a major factor when determining your auto insurance premium. If you have excellent credit and your score suddenly dips lower, you could get hit with a rate hike. The difference in price from excellent to bad credit is over $1,000. Make sure to keep a good credit score, so you can compare rates to find the best coverage.

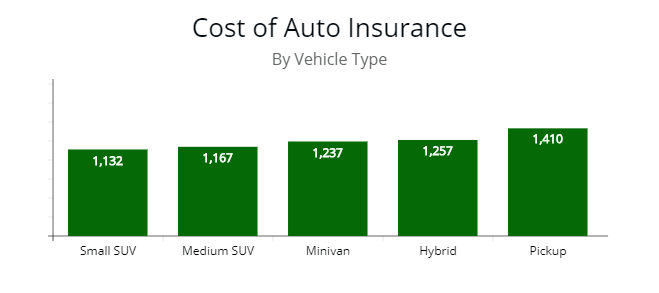

Car Insurance Rates by Vehicle Type

The type of vehicle you drive will also determine the amount you pay for an auto insurance premium.

Typically, the more expensive the vehicle make and model, the more you will pay, but not always.

Another good reason to make a car insurance comparison.

Note: The type of vehicle you drive is going to influence the cost of auto insurance. Illustrated above is the price of the premium for a small SUV to a pickup. All things being equal, the premium for a pickup is 20% more than a small SUV cost.

Note: The type of vehicle you drive is going to influence the cost of auto insurance. Illustrated above is the price of the premium for a small SUV to a pickup. All things being equal, the premium for a pickup is 20% more than a small SUV cost.

The more expensive it costs to replace parts on a vehicle, the more it costs to insure it.

More expensive vehicles have more expensive parts.

Another contributing factor is the safety rating.

If the vehicle has a poor safety rating, you could pay more for an auto insurance rate.

The risk is more drivers get injured with a poor safety rating in an auto accident.

Most vehicles today have excellent safety, however.

Car Insurance Rates by Marital Status

You are going to have to blame statistics on your marital status.

Statistics show single people get in more automobile accidents than their married counterparts.

Married people take fewer risks.

Below is illustrated the cost of car insurance policies for married and single drivers.

| Company* | Married | Single |

|---|---|---|

| Allstate | $1,411 | $1,553 |

| Auto-Owners | $1,529 | $1,688 |

| Erie | $1,481 | $1,639 |

| Farmers | $1,322 | $1,511 |

| Good2Go | $1,815 | $2,022 |

| Liberty Mutual | $1,490 | $1,621 |

| Mercury | $1,521 | $1,701 |

| Travelers | $1,416 | $1,528 |

| USAA | $1,218 | $1,481 |

| Wawanesa | $1,499 | $1,620 |

| State Farm | $1,456 | $1,600 |

| Geico | $1,420 | $1,528 |

*Some companies do not charge a difference between married and single drivers.

Car Insurance Rates by How Far You Drive

The distance you drive per year is going to determine your auto insurance premium when comparison shopping.

The more you drive, the higher chance you will be in an automobile accident.

| Annual mileage* | Premium Rates |

|---|---|

| 10,000 - 15,000 miles | $1,532 |

| 15,000 - 20,000 miles | $1,548 |

| 20,000 - 25,000 miles | $1,579 |

| 25,000 - 30,000 miles | $1,610 |

Does Filing a Claim Increase Your Auto Insurance Premium?

In most cases, filing a claim with auto insurance companies is going to increase your premium, especially if you were at fault.

As mentioned previously, an at-fault accident can increase your average rates from 30 to 50% and stay on your record for three years or more, depending on the state and insurer.

Insurers raise your rates to mitigate risk.

By doing so, you are more prudent and less likely to have an automobile accident.

On the other hand, if you have a minor fender bender and can get the damage fixed, you will probably be better off not filing an auto insurance claim.

If you file a claim, the increase in future premiums could cost more than the automobile damage itself.

Car Insurance Discounts

You can reduce the amount you pay for a premium with the use of discounts.

Every state and auto insurance carrier is different, so be sure to check with your insurer to get the benefits or discounts.

Some of the most common types of discounts are:

— Bundling car & home insurance

— Safe driver discounts

— Safety discounts

— Anti-Theft discounts

— Good student discounts

And itemized below are common auto insurance discounts and the percent reduction you could get.

| By Popularity | Discount Available | Typical Percentage |

|---|---|---|

| 1 | Multi-car | 10 Percent |

| 2 | Multi-policy | 10 Percent |

| 3 | Anti-theft or security system | 5 Percent |

| 4 | Good student | 5 Percent |

| 5 | Driver education | 10 - 15 Percent |

| 6 | Safety course | 10 - 20 Percent |

| 7 | VIN “etching” discounts* | 5 Percent |

Frequently Asked Questions

How do you compare car insurance plans?

Make sure you make a quote comparison of equal coverage levels. One policy may have more coverage than the other. One reason you could see higher insurance rates on one premium to the other.

Once you compare equal insurance plans, you want to check rates, features, customer reviews, and the satisfaction and process of their claims, according to Nerdwallet.com.

Why is my car insurance premium so high?

You may have a checkered driving history, filed claims, or had a lapsed in coverage.

All these contribute to higher insurance rates. If you have any of these in the past three years, most insurers will consider you high-risk and raise your premium.

Your credit score may also contribute to a high premium.

If you recently took out a loan or used more of your credit line, your score could drop, and insurers may raise your rate at renewal.

Other policy features that may cause your insurance rates to increase are extremely low deductibles, missed discounts, or excess coverage.

What is a No-Fault State?

States that require drivers to purchase Personal Injury Protection (PIP) are considered “no-fault state.”

Basically, this means your insurer will be required to pay for your medical costs if you’re hurt in an accident, no matter which motorist is actually at-fault for the crash.

What is a Tort State?

Contrary to no-fault, one driver must be found at fault during the automobile accident in a tort state.

Then that driver’s insurer is responsible for paying the medical costs.

As well as paying for additional damages such as missed wages and “pain and suffering.”

Most states are Tort States.

How Can I Lower my Premium?

If you have unnecessary coverage, you could drop it.

For example, if you carry comprehensive and collision insurance, you could drop both and get minimum coverage.

Drive fewer miles per year.

You could get cheaper car insurance by getting discounts.

What Determines the Cost of my Policy?

The factors determining your insurance policy are:

– Your driving record

– Location

– Marital status

– Coverage type and amount

– Past lapses in auto coverage

– Age

– Gender

– How far you drive

– Type of vehicle you are insuring

– And credit score unless you reside in California, Hawaii, Massachusetts, or Michigan.

Is Auto Insurance Required in your State?

Only two states do not require auto insurance – Virginia and New Hampshire.

It is urged to maintain liability coverage in both states, however.

Because if you don’t, then you’ll have to pay out-of-pocket for all the damages related to a crash you caused.

Methodology

AutoInsureSavings Coverage Methodology

| AutoInsureSavings.org used insurance data provided by Quadrant Information Services. Rates were publicly sourced from insurer filings and are intended for comparative purposes as your premiums could differ. Our sample driver a 30-year-old male drives 12,000 miles each year in a 2018 Honda Accord. |

Sources

The National Association of Insurance Commissioners (NAIC)

State Department of Insurance – California