Missouri Cheapest Car Insurance & Best Coverage Options

You can find Missouri cheapest car insurance and best coverage options at The Hartford and State Farm. The Hartford has the cheapest minimum coverage in Missouri, with average rates of $28 per month. State Farm provides the most affordable full coverage in Missouri, with average rates of $107 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Feb 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Feb 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Drivers looking for the Missouri cheapest car insurance and best coverage options should shop at The Hartford and State Farm. Getting quotes from the best auto insurance companies in Missouri will help drivers find the cheapest rates possible.

Read on to find out more about getting affordable Missouri car insurance. You can also use our free quote tool to get Missouri car insurance quotes instantly.

What’s the best cheap car insurance in Missouri?

Drivers can find the best coverage in Missouri and save more on car insurance premiums by comparing quotes from multiple insurance providers with our comparison study’s best rates.

| Cheapest Car Insurance in Missouri - Key Takeaways |

|---|

The cheapest Missouri car insurance options are: The cheapest Missouri car insurance options are:Cheapest for minimum coverage: The Hartford Cheapest for full coverage: State Farm Cheapest after an at-fault accident: State Farm Cheapest after a speeding ticket: American Family Cheapest after a DUI: Progressive Cheapest with poor credit history: American Family Cheapest for young drivers: American Family For younger drivers with a speeding violation: Shelter Insurance For younger drivers with an at-fault accident: State Farm |

This Missouri car insurance guide is the best way to find affordable auto insurance coverage and help you save money regardless of age groups or driving types.

- Car Insurance Rates in Missouri

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What’s the cheapest car insurance in Missouri for minimum coverage?

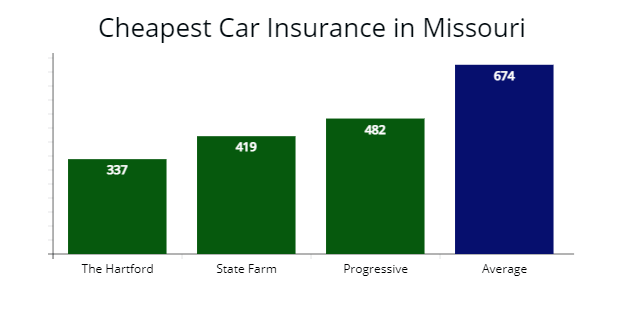

During our auto insurers’ analysis of Missouri’s best rates, The Hartford provided us a $337 per year or $28 per month for the cheapest minimum monthly premiums for liability insurance for good drivers in Missouri. The Hartford’s auto insurance premiums is 50% cheaper than Missouri’s state average of $674 per year.

| Auto insurer | Average annual rate |

|---|---|

| USAA | $316 |

| The Hartford | $337 |

| State Farm | $419 |

| Progressive | $482 |

| American Family | $519 |

| Geico | $544 |

| Allstate | $580 |

| Shelter | $653 |

| Farmers | $823 |

| Liberty Mutual | $931 |

*USAA is for qualified military members, their spouses, and direct family members. Rates may vary depending on driver profiles.

In Missouri, minimum liability coverage can ensure you have bodily injury, property damage liability, and uninsured motorist coverage to stay legal and have the cheapest possible premium. Still, it may not provide you with all the coverage you need if you are involved in an auto accident.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

In the event of an at-fault car accident, state minimum policies will not cover property damage to your car. To avoid expensive repairs, our licensed agents recommend full coverage policies when shopping for Missouri auto insurance rates.

What’s the cheapest full coverage car insurance in Missouri?

State Farm offers the cheapest insurance annual premiums for full coverage in Missouri for drivers with clean driving records. State Farm offered our sample driver a $1,287 annual rate or 36% less per year than Missouri’s average at $2,015 per year

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,287 | $107 |

| The Hartford | $1,460 | $121 |

| American Family | $1,619 | $134 |

| Missouri average | $2,015 | $167 |

Full coverage policies offer a better coverage level of protection for Missouri drivers, which covers property damage to the other driver’s car and your car by adding collision and comprehensive coverage.

Learn more: Understanding Full Coverage Car Insurance: What You Need to Know

Collision coverage pays for damage to your motor vehicle in the event of an auto accident, and comprehensive insurance pays for weather damage, such as from a storm or fallen tree branch or if you accidentally hit an animal.

Read more: Benefits of Adding Comprehensive & Collision Coverage & What’s the Difference?

Who has the cheapest car insurance with a speeding ticket for drivers in Missouri?

AutoInsureSavings insurance agents found American Family Insurance (AmFam) at $1,631 per year offers cheaper car insurance in Missouri for drivers who have one speeding violation on their driving record. American Family’s quote is 31% less expensive or $704 less per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| American Family | $1,631 | $135 |

| State Farm | $1,703 | $141 |

| Progressive | $1,948 | $162 |

| Missouri average | $2,335 | $194 |

Not sure how a traffic ticket can impact your car insurance rates? In Missouri, traffic tickets give rate increases by $320 or 14%, but not as much as a driver with an at-fault accident (33%) or DUI violation (52%).

Read more: How much will my auto insurance go up with a speeding ticket?

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

What’s the cheapest insurance with an auto accident in Missouri?

We found State Farm offers cheaper car insurance quotes to Missouri drivers with one at-fault accident on their driving records with a $1,852 annual rate ($154 per month) for our sample 30-year-old male driver.

State Farm’s rate is $1,057 less per year than Missouri’s’s state average rate of $2,909 or 37% less expensive.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,852 | $154 |

| Progressive | $2,035 | $169 |

| Geico | $2,357 | $196 |

| Missouri average | $2,909 | $242 |

Will car insurance rates increase after an accident? We found car insurance rates increase about 33% after a driver is involved in an accident in Missouri during our licensed agent’s analysis. Just one at-fault accident could cause your car insurance rates to increase as much as $894 per year or $74 per month.

Who has the cheapest car insurance for people with a DWI in Missouri?

With a drunk driving (DWI) violation, people in Missouri can find affordable car insurance with Progressive with a quote at $2,260 per year for full coverage or a $188 monthly rate for our sample 30-year-old driver.

Read more: Progressive Car Insurance Review for Families, Policy Options & Ratings

Progressive’s quote is 31% cheaper than Missouri’s DWI rate of $3,244 annually.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,260 | $188 |

| State Farm | $2,376 | $198 |

| American Family Insurance | $2,840 | $236 |

| Missouri average | $3,244 | $270 |

According to the Missouri Department of Revenue, a DWI conviction in Missouri will cause your car insurance premiums to increase by 52%. The DWI will remain on your driving record for ten years, and you may be required to participate in Missouri’s ignition interlock device (IID) program for first-time offenders. Shopping at the best car insurance companies after a DUI will help you keep rates lower.

What’s the cheapest insurance for drivers with poor credit in Missouri?

According to our analysis, the Missouri car insurance company offering the best rates with poor credit is American Family Insurance.

AmFam’s quote of $1,963 per year is 32% less expensive than state average rates of $2,860 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| American Family Insurance | $1,963 | $163 |

| State Farm | $2,017 | $168 |

| Shelter Insurance | $2,350 | $195 |

| Missouri average | $2,860 | $238 |

Who has the cheapest car insurance for young drivers in Missouri?

Young Missouri drivers can find the cheapest full coverage auto insurance rates with American Family Insurance, which provided us a $4,754 annual rate or 21% less expensive than Missouri’s younger driver average rates.

Shelter Insurance provides the cheapest minimum coverage rates for young or teen drivers at $1,419 per year or 32% lower than average Missouri rates.

The next best car insurance for teens for the state minimum is State Farm, at $1,477 per year.

| Auto insurer | Full coverage | Minimum coverage |

|---|---|---|

| USAA | $1,935 | $1,038 |

| American Family Insurance | $4,754 | $1,629 |

| State Farm | $4,890 | $1,477 |

| Shelter Insurance | $5,273 | $1,419 |

| Geico | $5,728 | $1,670 |

| Progressive | $6,613 | $2,235 |

| Farmers Insurance | $6,922 | $3,047 |

| Allstate | $7,025 | $1,518 |

| Liberty Mutual | $8,363 | $1,952 |

| Missouri average | $5,964 | $2,076 |

*USAA is for qualified military members, their spouses, and direct family members. Rates may vary depending on driver profiles.

According to the Insurance Information Institute (III.org), your age correlates with safe driving habits. Statistically, the younger you are, the higher likelihood you will be in a car accident.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

According to the National Highway Traffic Safety Administration (NHTSA), auto insurers account for this risk factor by charging higher insurance rates for inexperienced drivers. As you gain more driving experience, your rates should decrease as you get older.

What’s the cheapest insurance for young drivers with speeding tickets?

Teen drivers with speeding tickets in Missouri can find the cheapest quotes with Shelter Insurance. Average auto insurance costs with Shelter are $5,273 per year for full coverage or 21% less expensive than Missouri’s average speeding ticket rate for younger drivers.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Shelter Insurance | $5,273 | $439 |

| State Farm | $5,316 | $443 |

| Geico | $5,965 | $497 |

| Missouri average | $6,632 | $552 |

What’s the cheapest insurance for young drivers with an at-fault Accident?

Inexperienced Missouri drivers with a recent at-fault accident can find the best car insurance with State Farm with a $5,527 quote for full coverage insurance.

State Farm’s at-fault accident rate for young drivers is 24% cheaper than Missouri’s average rate of $7,238 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $5,527 | $460 |

| Shelter Insurnace | $5,963 | $496 |

| American Family Insurance | $6,230 | $519 |

| Missouri average | $7,238 | $603 |

Learn more: 5 Tips to Get Cheap Car Insurance after an Accident

Best Auto Insurance Companies in Missouri

Based on customer service and claims satisfaction, Missouri’s best car insurance companies are American Family Insurance, Shelter Insurance, and USAA.

If customer service is a priority with a low amount of complaints based on NAIC’s index, we recommended American Family (AmFam) as the best auto insurer in Missouri.

| Auto insurer | % respondents satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| American Family Insurance | 86% | 50% |

| USAA | 78% | 62% |

| Shelter | 75% | 51% |

| Progressive | 74% | 34% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Farmers Insurance | 71% | 38% |

| Geico | 64% | 42% |

Buying cheap insurance helps Missouri insurance shoppers save money, but insurance companies with poor customer service or claims handling sometimes are not worth the extra savings in your bank account.

AutoInsureSavings licensed agents collected information on Missouri’s car insurance companies from the National Association of Insurance Commissioners (NAIC), J.D. Powers, and A.M. Best’s financial strength ratings.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

The insurance companies with the lowest NAIC complaint index ratio based on the market share are American Family (0.46), Farmers Insurance (0.49), and Shelter (0.51). All three auto insurers have an NAIC complaint index of less than one (1.00) or below the national average.

| Insurer | NAIC Complaint Index | J.D. Power claims satisfaction score | AM Best Financial Strength Rating |

|---|---|---|---|

| American Family Insurance | 0.46 | 862 | A |

| Farmers | 0.49 | 872 | A |

| Shelter | 0.51 | n/a | A |

| Allstate | 0.63 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| USAA | 0.68 | 890 | A++ |

| Progressive | 0.76 | 856 | A+ |

| Liberty Mutual | 0.97 | 866 | A+ |

| Geico | 1.02 | 871 | A++ |

While you shop around for car insurance companies in The Show-Me State, several factors contribute to your insurance cost. Your driver profile, type of vehicle, and age can impact your total monthly or annual insurance premium.

It is always best to shop around and compare plans to find a Missouri car insurance company with the cheapest rates with excellent customer service ratings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What’s the average car insurance cost by city in Missouri?

We collected insurance quotes from Missouri zip codes from top auto insurance companies, and found rates can vary by $567 by zip code and city.

Your zip code in The Show-Me State is one of many risk factors auto insurers use to set your auto insurance quotes. Other factors include your marital status, type of vehicle, credit score, age, and liability insurance limits.

Who has the cheapest auto insurance in Kansas City, MO?

Drivers in Kansas City, MO, can find the best auto insurance rates with The Hartford, which provided us a quote at $1,371 per year for a full coverage insurance policy. The Hartford’s rate is 45% cheaper than Kansas City’s insurance rate of $2,465 per year.

| Kansas City insurance | Average Premium |

|---|---|

| The Hartford | $1,371 |

| State Farm | $1,390 |

| Geico | $1,543 |

| Kansas City average | $2,465 |

Who has the cheapest auto insurance in St. Louis, MO?

AutoInsureSavings’ agents found State Farm is the cheapest liability car insurance company for people in St. Louis. They provided us a $1,517 per year rate for full coverage, 41% less expensive than St. Louis’s average rates at $2,547 per year.

| St. Louis insurance | Average Premium |

|---|---|

| State Farm | $1,517 |

| American Family Insurance | $1,689 |

| Shelter Insurance | $1,840 |

| St. Louis average | $2,547 |

Who has the cheapest auto insurance in Springfield, MO?

Springfield drivers can find the best full coverage insurance policy with American Family Insurance, which provided us a quote at $1,458 per year. AmFam’s insurance quote is 39% cheaper than average rates for 30-year-old drivers in Springfield.

| Springfield insurance | Average Premium |

|---|---|

| American Family Insurance | $1,458 |

| State Farm | $1,570 |

| Progressive | $1,872 |

| Springfield average | $2,376 |

Who has the cheapest auto insurance in Columbia, MO?

Through research, we found the cheapest auto insurance in Columbia is The Hartford, with a $121 monthly rate or $1,455 per year. The Hartford’s rate is 40% less expensive than Columbia’s average rates of $2,442 per year.

| Columbia insurance | Average Premium |

|---|---|

| The Hartford | $1,455 |

| Shelter Insurance | $1,562 |

| Farmers | $1,727 |

| Columbia average | $2,442 |

Who has the cheapest auto insurance in Independence, MO?

Independence drivers can find the cheapest auto insurance quotes with State Farm, which provided our agents a $1,217 rate per year for our 30-year-old driver. State Farm’s quote is 48% less expensive than Independence’s average rates.

| Independence insurance | Average Premium |

|---|---|

| State Farm | $1,217 |

| Progressive | $1,353 |

| Geico | $1,461 |

| Independence average | $2,374 |

Who has the cheapest auto insurance in Lee’s Summit, MO?

Drivers in Lee’s Summit looking for cheaper car insurance rates should get quotes from State Farm, which offered our agents a $1,198 annual rate for full coverage with $500 deductibles with collision and comprehensive coverage. State Farm’s rate is 47% less expensive than Lee’s Summit’s average rates of $2,257 per year.

| Lee's Summit insurance | Average Premium |

|---|---|

| State Farm | $1,198 |

| Shelter Insurance | $1,340 |

| Geico | $1,446 |

| Lee's Summit average | $2,257 |

Average Car Insurance Costs for All Cities in Missouri

| City | Annual insurance cost | City | Annual insurance cost |

|---|---|---|---|

| Kansas City | $2,465 | El Dorado Springs | $1,893 |

| St. Louis | $2,547 | Frontenac | $1,880 |

| Springfield | $2,376 | Tipton | $1,918 |

| Columbia | $2,442 | Riverside | $1,856 |

| Independence | $2,374 | Cuba | $1,937 |

| Lee's Summit | $2,257 | Pagedale | $1,953 |

| O'Fallon | $2,249 | Sugar Creek | $1,946 |

| St. Joseph | $2,314 | Cassville | $1,912 |

| St. Charles | $2,423 | Louisiana | $1,880 |

| St. Peters | $2,165 | Hillsboro | $2,065 |

| Blue Springs | $2,189 | Bethany | $2,035 |

| Florissant | $2,317 | Buffalo | $1,968 |

| Joplin | $2,385 | Buckner | $1,918 |

| Chesterfield | $1,918 | Moscow Mills | $2,092 |

| Jefferson City | $1,937 | Portageville | $1,953 |

| Cape Girardeau | $1,893 | East Prairie | $2,116 |

| Wentzville | $2,170 | Pleasant Valley | $1,946 |

| Oakville | $2,146 | Byrnes Mill | $1,912 |

| Wildwood | $2,159 | Versailles | $1,937 |

| University City | $2,198 | Windsor | $1,880 |

| Liberty | $1,968 | Chaffee | $1,953 |

| Ballwin | $1,893 | Concordia | $1,856 |

| Raytown | $2,035 | New Madrid | $1,985 |

| Mehlville | $2,186 | Ava | $2,065 |

| Kirkwood | $2,107 | Riverview | $2,170 |

| Gladstone | $1,946 | Castle Point | $1,893 |

| Maryland Heights | $1,856 | Knob Noster | $2,092 |

| Hazelwood | $2,172 | Country Club | $2,048 |

| Grandview | $1,912 | Licking | $2,065 |

| Belton | $1,918 | Bel-Ridge | $1,985 |

| Webster Groves | $1,937 | Gray Summit | $2,035 |

| Sedalia | $1,953 | Piedmont | $2,107 |

| Nixa | $1,880 | Fayette | $2,159 |

| Raymore | $2,048 | Warsaw | $2,092 |

| Arnold | $2,183 | Montgomery City | $2,048 |

| Ferguson | $2,260 | Clever | $1,912 |

| Rolla | $2,194 | Kimberling City | $2,059 |

| Affton | $1,946 | Terre du Lac | $2,172 |

| Warrensburg | $1,893 | Mountain View | $2,215 |

| Old Jamestown | $2,035 | Hayti | $2,059 |

| Ozark | $2,065 | Green Park | $1,937 |

| Creve Coeur | $1,912 | Clarkson Valley | $1,893 |

| Farmington | $2,092 | Oronogo | $1,953 |

| Manchester | $2,232 | Potosi | $1,985 |

| Concord | $2,287 | Villa Ridge | $1,856 |

| Kirksville | $2,065 | Owensville | $2,172 |

| Spanish Lake | $2,196 | Houston | $1,968 |

| Hannibal | $2,212 | Marlborough | $1,912 |

| Poplar Bluff | $2,281 | Forsyth | $1,880 |

| Lemay | $1,856 | Seneca | $1,946 |

| Clayton | $1,893 | Milan | $2,159 |

| Republic | $1,937 | Canton | $2,213 |

| Sikeston | $2,035 | Hermann | $2,107 |

| Fort Leonard Wood | $1,985 | Cabool | $1,953 |

| Lake St. Louis | $1,968 | Marionville | $1,893 |

| Overland | $2,059 | Moline Acres | $1,918 |

| Jackson | $1,912 | Monroe City | $2,210 |

| Jennings | $1,946 | Holden | $2,035 |

| Carthage | $1,918 | Village of Four Seasons | $2,065 |

| Lebanon | $2,288 | Thayer | $1,856 |

| Washington | $2,200 | Elsberry | $1,937 |

| Grain Valley | $2,172 | St. Paul | $1,968 |

| Moberly | $2,227 | Carterville | $1,946 |

| Dardenne Prairie | $1,893 | Plattsburg | $2,059 |

| Marshall | $2,065 | Willow Springs | $1,985 |

| Fulton | $1,953 | Merriam Woods | $2,092 |

| St. Ann | $1,880 | Bloomfield | $1,893 |

| West Plains | $2,236 | Lathrop | $2,159 |

| Troy | $2,172 | Kahoka | $1,918 |

| Neosho | $2,240 | Lawson | $1,912 |

| Festus | $2,107 | Noel | $1,968 |

| Crestwood | $1,937 | Lake Lotawana | $2,196 |

| Webb City | $1,856 | Strafford | $2,210 |

| Maryville | $2,035 | Weatherby Lake | $2,219 |

| Excelsior Springs | $1,893 | Anderson | $2,236 |

| Bridgeton | $1,968 | Doniphan | $2,035 |

| Mexico | $2,092 | St. George | $2,210 |

| Union | $1,946 | Slater | $2,172 |

| Branson | $1,985 | Granby | $2,065 |

| Town and Country | $2,059 | Warson Woods | $1,856 |

| Bolivar | $1,918 | New Haven | $1,953 |

| Eureka | $2,210 | Seymour | $1,937 |

| Bellefontaine Neighbors | $1,912 | Albany | $1,968 |

| Kearney | $1,856 | Marceline | $1,946 |

| Kennett | $2,243 | Steele | $2,035 |

| Harrisonville | $1,880 | Bourbon | $2,219 |

| Smithville | $2,209 | Wellston | $1,893 |

| Cameron | $2,107 | Duquesne | $2,159 |

| Ellisville | $2,219 | Hamilton | $2,236 |

| Chillicothe | $1,953 | Wardsville | $2,059 |

| Clinton | $2,065 | Hanley Hills | $1,985 |

| Monett | $1,893 | Adrian | $1,856 |

| Berkeley | $1,937 | Lake Ozark | $1,918 |

| Des Peres | $2,196 | Campbell | $1,912 |

| Ladue | $2,172 | Bernie | $1,968 |

| Park Hills | $1,856 | Stockton | $1,893 |

| Pleasant Hill | $2,207 | Cedar Hill | $2,092 |

| Richmond Heights | $1,946 | Unionville | $2,107 |

| Sunset Hills | $1,918 | Richland | $2,065 |

| Perryville | $2,035 | Marble Hill | $2,059 |

| Boonville | $2,159 | Hallsville | $1,880 |

| Nevada | $2,210 | Senath | $1,937 |

| Warrenton | $1,918 | Salisbury | $1,953 |

| Oak Grove | $1,985 | Steelville | $1,946 |

| Carl Junction | $1,968 | Weston | $2,035 |

| Maplewood | $1,893 | Oakland | $2,210 |

| Brentwood | $2,203 | Memphis | $2,236 |

| Murphy | $2,236 | Sarcoxie | $1,918 |

| Dexter | $2,092 | Huntsville | $2,219 |

| Olivette | $1,912 | Charlack | $2,196 |

| Sappington | $2,201 | Shelbina | $1,856 |

| Aurora | $1,946 | Vinita Park | $2,048 |

| Marshfield | $2,172 | Gower | $2,065 |

| Bonne Terre | $1,953 | Sparta | $2,110 |

| Black Jack | $1,856 | Gallatin | $1,985 |

| Valley Park | $1,937 | Claycomo | $1,946 |

| Parkville | $2,035 | Ash Grove | $1,893 |

| Sullivan | $2,059 | Lakeshire | $1,968 |

| St. John | $1,880 | Greenfield | $2,210 |

| De Soto | $1,918 | Ironton | $2,159 |

| Pacific | $2,065 | Oran | $2,211 |

| Greenwood | $1,893 | Tarkio | $2,035 |

| Battlefield | $2,092 | Rich Hill | $1,918 |

| Shrewsbury | $2,172 | LaBarque Creek | $1,856 |

| St. Robert | $2,219 | Linn | $1,912 |

| Barnhart | $2,219 | Bel-Nor | $1,937 |

| Pevely | $2,035 | Bismarck | $2,196 |

| Glendale | $1,985 | Leadwood | $1,953 |

| Trenton | $2,210 | Rock Port | $2,228 |

| Richmond | $1,918 | Belle | $2,059 |

| Caruthersville | $2,236 | Fair Grove | $1,880 |

| Charleston | $1,968 | Country Club Hills | $1,893 |

| Weldon Spring | $2,225 | Crane | $2,048 |

| Willard | $1,946 | Velda City | $2,172 |

| Bowling Green | $2,219 | Sweet Springs | $1,918 |

| Macon | $1,937 | Paris | $2,035 |

| Waynesville | $1,856 | Duenweg | $2,159 |

| Odessa | $1,953 | Goodman | $2,065 |

| Cottleville | $2,107 | Lone Jack | $1,946 |

| Savannah | $2,172 | Winchester | $2,092 |

| Peculiar | $2,196 | Advance | $1,856 |

| Osage Beach | $1,893 | Marthasville | $1,968 |

| Dellwood | $1,912 | Taos | $1,985 |

| Salem | $1,880 | Garden City | $2,196 |

| Glasgow Village | $2,035 | Calverton Park | $1,953 |

| Platte City | $1,918 | Clarkton | $2,172 |

| Desloge | $1,937 | Hillsdale | $2,217 |

| Normandy | $2,059 | Winfield | $2,035 |

| Crystal City | $2,159 | Winona | $2,219 |

| St. Clair | $2,048 | Gerald | $1,893 |

| Mountain Grove | $1,953 | Purdy | $2,109 |

| Eldon | $2,092 | Mansfield | $2,214 |

| Rock Hill | $1,968 | Pierce City | $2,196 |

| Higginsville | $1,985 | Reeds Spring | $1,937 |

| Breckenridge Hills | $2,065 | La Plata | $1,912 |

| Lexington | $1,856 | Maysville | $1,880 |

| Hollister | $1,953 | Stanberry | $1,918 |

| Mount Vernon | $1,946 | Edina | $2,159 |

| Scott City | $2,213 | Cole Camp | $1,968 |

| North Kansas City | $1,893 | Edmundson | $1,856 |

| High Ridge | $2,181 | Archie | $2,159 |

| Ste. Genevieve | $2,196 | New Franklin | $2,059 |

| California | $2,108 | Wellsville | $1,985 |

| Brookfield | $2,172 | Ellington | $1,946 |

| Lamar | $2,035 | La Monte | $2,048 |

| Imperial | $1,918 | Stover | $1,937 |

| Centralia | $1,953 | Lockwood | $2,181 |

| Holts Summit | $1,912 | Appleton City | $2,092 |

| Whiteman AFB | $1,880 | St. Martins | $2,172 |

| Malden | $1,937 | Cool Valley | $2,035 |

| Vandalia | $2,048 | Princeton | $1,918 |

| Butler | $2,167 | Lilbourn | $1,893 |

| Northwoods | $1,856 | Horine | $2,198 |

| St. James | $2,159 | Dixon | $2,188 |

| Woodson Terrace | $2,059 | Lake Winnebago | $2,178 |

| Camdenton | $1,985 | Crocker | $2,107 |

| Herculaneum | $1,937 | Shell Knob | $2,065 |

| Fenton | $1,968 | Auxvasse | $1,856 |

| Fredericktown | $1,918 | Southwest City | $2,048 |

| Ashland | $1,946 | Fremont Hills | $1,912 |

| Wright City | $2,065 | Mound City | $1,985 |

| Rogersville | $1,893 | Miner | $1,953 |

| Carrollton | $2,039 | Glasgow | $1,918 |

| Palmyra | $1,856 | Kissee Mills | $1,937 |

| Pine Lawn | $1,912 | Osceola | $1,880 |

What are the minimum car insurance coverage requirements in Missouri?

According to state law and the Missouri Department of Revenue, all drivers must carry the minimum liability insurance requirements and uninsured motorist coverage.

| Liability insurance | Minimum coverage |

|---|---|

| Bodily injury liability | $25,000 per person / $50,000 per accident |

| Property damage liability | $10,000 per accident |

| Uninsured motorist coverage bodily injury | $25,000 per person / $50,000 per accident |

The insurance requirements pay for bodily injury and property damage sustained to other people or motor vehicles. Uninsured motorist coverage pays for accidents with uninsured motorists.

AutoInsureSavings agents recommend higher bodily injury and property damage liability limits with comprehensive and collision insurance.

To learn more about the most affordable car insurance options for drivers in Missouri, contact the experts at AutoInsureSavings.org. Our licensed insurance professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping insurance study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used insurance rates for drivers with accident histories, credit scores, and marital status for other Missouri rate analyses. We used car insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your insurance rates may vary when you get quotes.

So compare prices between auto insurance companies to find the lowest rate.

Sources

– Missouri Department of Revenue. “Insurance Information.”

– Insurance Information Institute. “Background on Credit scoring.”

– National Highway Traffic Safety Administration. “Traffic Safety Facts.”

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

– Missouri State Highway Patrol. “Young Driver Crashes by Crash Severity and Personal Injury Severity.”

– Missouri Department of Revenue. “The Missouri Driver License and Nondriver License.”

– Missouri Department of Revenue. “Driving While Intoxicated (DWI).”

Frequently Asked Questions

Who has the cheapest car insurance in Missouri?

We found the top car insurance companies that offer the lowest Missouri driver’s average rates are USAA at $26 per month, The Hartford at $28 per month, and State Farm at $35 a month for a liability insurance policy for a 30-year-old with clean driving history.

How much is car insurance in Missouri per month?

The average cost for car insurance per month in Missouri is $167 per month or $2,015 per year for full coverage. The average price of a minimum coverage car insurance policy per month is $56 or $674 per year. State Farm’s full coverage average rate is $107 per month or 36% less expensive, while The Hartford offers state minimum policies in Missouri at $28 per month or 50% cheaper than state average rates.

How much is full coverage car insurance in Missouri?

The average cost of full coverage car insurance in Missouri is $2,015 annually or $167 per month. State Farm’s average rate for full coverage is $1,287 per year or $107 per month. The Hartford at $1,460 and American Family Insurance at $1,619 are also below the state average rates.

How can I save on car insurance in Missouri?

There are many ways for drivers in Missouri to save on their car insurance premiums. You can determine if you are eligible for a money-saving driver discount offered by the car insurance company. Many insurance providers will lower your overall rates if you have multi-policies with them, such as life or home insurance.

Another way to save on your car insurance premium is to practice good driving habits and keep a clean driving record. That will not only keep you and your passengers safe but will also help you avoid auto accidents or traffic violations that could cause rate increases.

Who has the most affordable Missouri car insurance?

The best insurance companies in Missouri for cheap insurance are The Hartford and State Farm.

Is car insurance more expensive in Missouri?

The average cost of car insurance in Missouri is slightly below the nationwide average. If your rates are expensive, it may be because of your driving record or choice of company.

What is the best Missouri car insurance?

The best Missouri auto insurance is full coverage, as this provides the most protection in case of an accident.

Is Missouri a no-fault state?

No, Missouri is an at-fault auto insurance state.

Does car insurance follow the vehicle or the driver in Missouri?

Most liability insurance policies will be on the car, not the driver.

Is it illegal to drive without insurance in Missouri?

Yes, all drivers must have auto insurance in Missouri to drive legally.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Feb 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.